Would I lie to you?

Until a year ago very few people had ever heard of Martin Shkreli. In 2015 the then-32-year-old CEO of Turing Pharmaceuticals LLC became the poster boy for Big Pharma eXXXcesses when Turing acquired rights to Daraprim, an antiparasitic drug used widely to treat toxoplasmosis. The acquisition itself wasn’t particularly controversial. Raising the price of Daraprim from $13.50 per pill to $750 per pill was.

And so another round of hand-wringing and teeth-gnashing over health care costs began. There was a Congressional hearing where Shkreli preened and smirked and refused to answer questions, later asserting that he had been subpoenaed “unethically” and that it is, “hard to accept that these imbeciles represent the people in our government.” Benjamin Brafman, Shkreli’s attorney, clarified afterward that, “he meant no disrespect…” He wouldn’t want to leave the wrong impression.

Turing later halved the effective price to $375 per pill but that still represented a 2,700% increase over the original $13.50. Daraprim is on the World Health Organization’s List of Essential Medicines by its generic name (pyrimethamine) for its use in treating toxoplasmosis, a killer of pregnant women and those with compromised immune systems. It is “the leading cause of focal central nervous system (CNS) disease in AIDS.”

Indeed, Turing is not the only company to raise drug prices astronomically. Anyone prone to anaphylaxis knows the EpiPen®, a product of Mylan Pharmaceuticals. The EpiPen® can be carried in a pocket or purse and in an emergency, jabbed into a thigh to deliver a metered dose of life-saving epinephrine. A decade ago a two-pack cost about $94. Today it averages $608. And EpiPens® expire. The manufacturer states that “Each new EpiPen® should have a minimum of 12 months before expiry.” That works out to about $50 per month. Epinephrine is cheap. The epinephrine in an EpiPen® costs at most $0.045 in wholesale quantities, less than a nickel.

Hepatits C “is a serious disease that can result in long-term health problems, including liver damage, liver failure, liver cancer, or even death.” Gilead Science, maker of the Hepatitis C drug Sovaldi (sofosbuvir), sells a typical 12 week course of treatment for $84,000. The drug has an impressive cure rate; perhaps as high as 90%. Manufacturing costs are estimated to be $1,400.

These extraordinary prices can be explained, of course. Merck CEO Kenneth Frazier says, “There’s a huge challenge we face between trying to optimize access to our drugs in whatever pricing we establish, and trying to ensure that you have the resources to continue to pursue the next generation of drugs.” The Washington Post quotes Turning spokesman Craig Rothenberg as saying that Turing “will use the money from the sales to further research treatments for toxoplasmosis.” The Post continues, “the firm had plans to invest in marketing and education tools to raise awareness of the disease.” And Heather Bresch, CEO of Mylan, the company that makes the EpiPen® is quoted by CNBC as noting that Mylan’s costs include, “manufacturing the product, distributing the product, enhancing the product, investing.” Apparently Ms. Bresch believes that other manufacturing companies don’t have those costs. Ms. Bresch was earning subsistence compensation of $2,453,456 in 2007 when she engineered the acquisition of EpiPen® from Merck and jacked the product price 600%. In 2015 she earned $18,931,068, ensuring that she would be able to afford EpiPens® for her own children should they need them. The bottom line for all of them? R&D is, like, really expensive.

Not getting what you pay for

In the August 23 issue of JAMA, Kesselheim et al., find that per capita prescription drug spending in the United States exceeds that in all other countries, largely driven by brand-name drug prices that have been increasing in recent years at rates far beyond the consumer price index. In 2013, annual per capita spending on prescription drugs was $858 compared with an average of $400 for 19 other industrialized nations.

Indeed, health care costs in general are much higher in the United States than in other OECD nations. Using World Bank numbers from 2014, the OECD average per capita health care expenditure was $4,741. In the United States we spent $9,403. Spending so much more than other industrialized nations, the US must have the finest health care in the world, right? According to the Commonwealth Fund, the US ranks last among 11 industrialized nations studied, pulled down by, among other factors, high cost and dismal efficiency. The US did not score first in any of the components measured. The UK, which spends about 40% per capita of what the US spends, ranked first in most of the measures.

This level of spending matters. There are roughly 320 million Americans. The difference between spending $9,403 versus $4,741 on each of them is $4,662 per person. In total that is $1,491,840,000,000 in excess spending and given the poor performance of US health care that $1.5 trillion dollars can only be seen as waste. To put that number in perspective, the United States 2014 defense budget was $526.6 billion, $615.1 billion including the Overseas Contingency Operations “slush fund.” Looked at from another perspective, it would cost the government a mere $62.6 billion to provide free public university education. That is to say, if we spent the OECD per capita average, we could double the defense budget, provide free public university education to all, and have the combined GDPs of Florida and Minnesota left over to spend on new drapes for the Clinton White House.

Focusing on pharmaceuticals, Kesselheim identifies two factors:

Drug prices are higher in the United States than in the rest of the industrialized world because, unlike that in nearly every other advanced nation, the US health care system allows manufacturers to set their own price for a given product.

Drug companies’ ability to maintain high prices in the United States is based on 2 market forces: protection from competition and negotiating power.

The first observation that the United States differs from the rest of the industrialized world in letting pharmaceutical companies set their own prices may surprise some American readers for whom the primacy of free markets is an article of faith. The fundamental concept is that the tension between supply and demand and the competition between various suppliers will result in low prices and high quality. David Halberstam celebrated this in The Reckoning, where he described the impact of high quality, low cost Japanese vehicles on the US automobile industry.

But, but, but, we spend lots on research and development

But drugs are not automobiles and medical markets are in no sense free. Pharmaceuticals are perhaps the most tightly regulated products in existence. Medicinet estimates that it takes 12 years on average for a new drug to move from laboratory to pharmacy shelves. A potential new drug spends several years in preclinical testing, then an Investigational New Drug Application is filed with the Food and Drug Administration (FDA), followed by three iterations of clinical studies. If all goes well the result is a New Drug Application (NDA) filed with FDA. The General Accounting Office reports that as of 2011, 96% of NDA submissions were reviewed within 10 months, the decision interval goal set by the FDA.

The costs related to this regulatory gauntlet are considerable. DiMasi et al. report the average capitalized cost including Phase IV post-approval costs for each approved compound to be $2.87 billion. Forbes magazine evaluated R&D spending over a 15 year period for a dozen pharmaceutical companies and found per approved drug costs ranging from $3.7 billion to a staggering $11.8 billion. The variation in cost reflects the variation in success. The Forbes authors divided each company’s R&D spending by the number of drugs approved. Those with more drugs failing to transit the pipeline consequently have higher costs associated with the drugs that do.

All of this seems to suggest that the cost of drugs only appears to be high, that in fact given the high development costs and long lead times, consumers are lucky that pharmaceutical companies are willing to take the risks associated with new drug development.

Kesselheim counters:

First, important innovation that leads to new drug products is often performed in academic institutions and supported by investment from public sources such as the National Institutes of Health. A recent analysis of the most transformative drugs of the last 25 years found that more than half of the 26 products or product classes identified had their origins in publicly funded research in such nonprofit centers. Other analyses have highlighted the importance of small companies, many funded by venture capital. These biotech startups frequently take early-stage drug development research that may have its origins in academic laboratories and continue it until the product and the company can be acquired by a large manufacturer, as occurred with sofosbuvir.

Arguments in defense of maintaining high drug prices to protect the strength of the drug industry misstate its vulnerability. The biotechnology and pharmaceutical sectors have for years been among the very best-performing sectors in the US economy. The proportion of revenue of large pharmaceutical companies that is invested in research and development is just 10% to 20% (Table 4); if only innovative product development is considered, that proportion is considerably lower. The contention that high prescription drug spending in the United States is required to spur domestic innovation has not been borne out in several analyses. A more relevant policy opportunity would be to address the stringency of congressional funding for the National Institutes of Health, such that its budget has barely kept up with inflation for most of the last decade. Given the evidence of the central role played by publicly funded research in generating discoveries that lead to new therapeutic approaches, this is one obvious area of potential intervention to address concerns about threats to innovation in drug discovery.

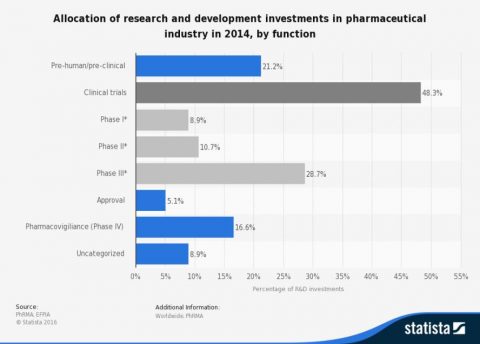

Americans invest over $32 billion annually in medical research through the National Institutes of Health (NIH) alone. To put that in perspective Pfizer’s entire 2014 R&D budget was about $7.2 billion. But even this doesn’t tell the whole story because R&D means research and development. While NIH funding is almost entirely for basic research, the sort of fundamental research that fuels new understandings, opens new avenues and leads to new drugs and therapies, Big Pharma spends most of its R&D money on the development end – clinical trials.

So of Pfizer’s $7.2 billion R&D budget, perhaps 1.5 billion goes to basic research. Even there much of pharmaceutical companies’ R&D feeds on publicly-funded research. In a study published in Health Affairs, Kesselheim et al. note:

Perhaps the most common pattern of interaction involved academic scientists’ conceptualizing a therapeutic approach based on basic research about disease mechanisms and then demonstrating the proof of concept for a given molecule. Industry collaborators then developed the product for more extensive clinical testing.

The point here is that pharmaceutical companies are increasingly in the business of running clinical trials and marketing drugs rather than plowing the hard ground for new discoveries. In this sense the basic research costs are socialized while the profits, increasingly breathtaking profits, are privatized.

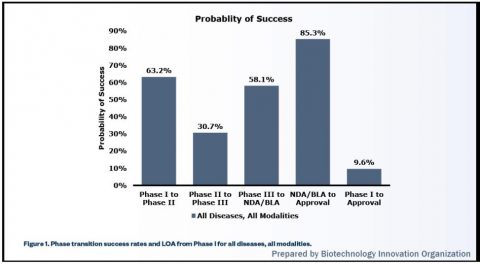

This is not to ignore the very high costs associated with clinical trials. As the Statistica chart above shows, half of pharmaceutical company R&D spending goes to clinical trials. The curious can find a brief explanation of clinical trial phases on the NIH website. The Biotechnology Innovation Organization, a trade association, states that less than 10% of new drugs make it through clinical trials and are ultimately approved.

This high attrition rate magnifies the cost per drug approved. So why is the attrition rate so high? Part of the problem is the misuse and misinterpretation of p-values. Friend of SBM David Colquhoun explored this problem at some depth concluding that, “if you use p=0.05 as a criterion for claiming that you have discovered an effect you will make a fool of yourself at least 30% of the time.” When the consequences are measured in tens or hundreds of millions of dollars, foolishness is to be discouraged. David Granger used Professor Colquhoun’s approach to examine the impact of p=0.05 idolatry and misinterpretation specifically as it applies to drug trials and concluded that fewer than “2 out of every three positive trial results were real.”

This would seem to demand rigorous replication of foundational laboratory and pre-clinical results. As Errington, Nosek, et al. note, “Despite being a defining feature of science, reproducibility is more an assumption than a practice in the present scientific ecosystem.” Without careful vetting at the earliest stages of investigation, hundreds of millions of dollars can be wasted chasing a false premise through the gauntlet of clinical trial. Garbage in will never produce gospel out regardless of the amount of cash squandered in the effort. The important point here is that this is not a failure of science and not a failure of regulatory overreach, it is a failure of basic due diligence. Some of this procedural elision may owe to competitive pressures. Patent law is a winner-take-all system that places absolute value on being first.

This and other market forces have driven changes in the industry. For a while the industry went through a period of “swinging for the fences” where every company chased blockbuster drugs. That model is changing with drug companies now trying to produce more drugs for smaller markets and then trying to expand the indications for which the drug is used. This is sometimes successful as it was with Novartis’ Afinitor (everolimus). First approved for patients with advanced renal cancers, everolimus was later approved for subependymal giant cell astrocytoma (SEGA), then for pancreatic neuroendocrine tumors, then for non-cancerous kidney tumors in patients with tuberous sclerosis complex, then for women with ER-postive, HER2-negative breast cancer, then for certain lung and gastrointestinal tumors. In essence this model tries to squeeze ever more toothpaste out of the same tube. Sometimes this is tried without the niceties of clinical trials and formal approvals by promoting off-label uses. Many of Big Pharma’s biggest players have been hit with fines running into the hundreds of millions and even the billions of dollars for promoting drugs for unapproved indications. The judgment can be (but isn’t always) made that gambling on clinical trials for expanded use is less expensive than attracting the ire of regulatory authorities.

Finally, an increasing amount of pharmaceutical innovation is done in the offices of investment bankers where merger and acquisition (M&A) deals are cobbled together. Small startups raise venture capital to develop an idea that often grew from the academic research of one or more of the founders. As the concept matures one of the multinational Pharma giants steps in, offers a deal that allows the venture capitalists and founders to cash out, and carries the product through the final stages of approval and marketing. Or a company like Turing or Mylan acquires a legacy product from another manufacturer and jacks up the price without, in fact, doing much of anything else. This model is very much closer to merchandising than to traditional pharmaceutical research and development. It is a particularly egregious form of what economists call ‘rent-seeking’, where resources are employed to obtain economic gain without the concomitant reciprocal benefit to society of wealth creation. The significant regulatory burden associated with pharmaceutical products make this sort of rent-seeking particularly easy. And the case can be made that industry-wide rent-seeking explains the legal prohibition of federal negotiation of drug prices. The US alone allows drug companies to charge whatever the market will bear.

The very bottom line

The bottom line is that industry claims that highly inflated drug prices are necessary to fuel new drug research doesn’t bear close scrutiny. Much of the fundamental research is done in academic settings using public money. The regulatory expense of bringing entirely new drugs to market is high but much of that cost owes to a high attrition rate during clinical trialing which itself owes to fundamental errors in choosing promising candidates. And a growing trend is for pharmaceutical companies to specialize in sales and marketing rather than research and development.

So why then are pharmaceutical companies charging so much? Marcia Angell, former editor-in-chief of The New England Journal of Medicine examined this issue in a recent Washington Post editorial and concluded, “Because they can.”